Book Appointment Now

Zakat

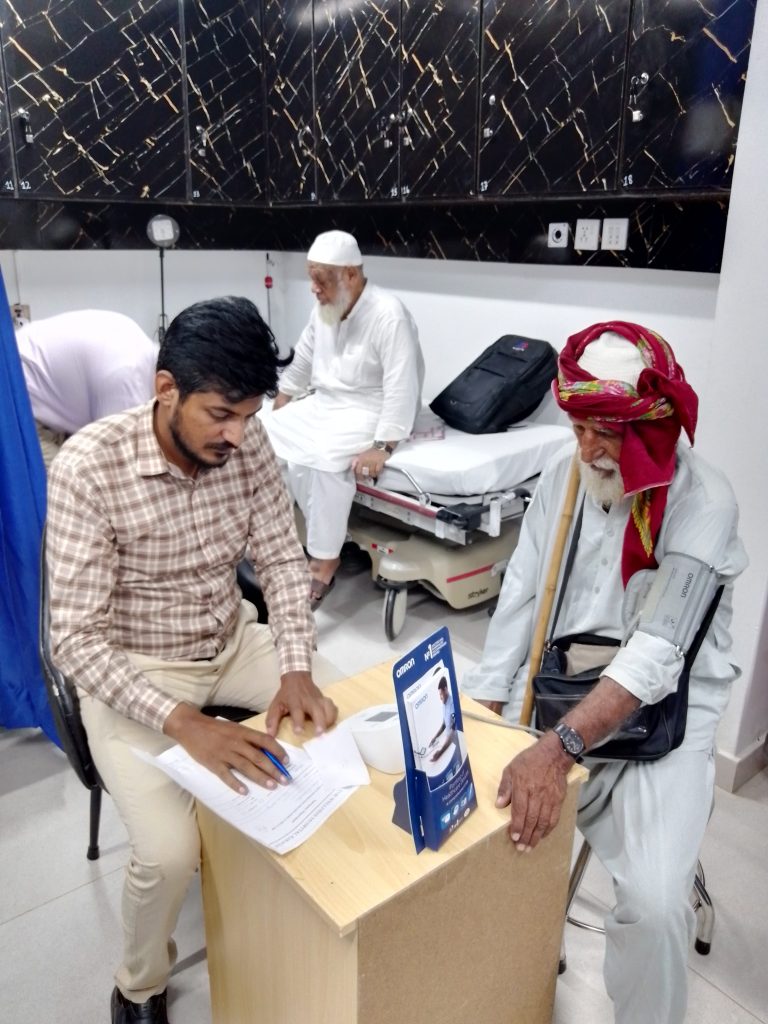

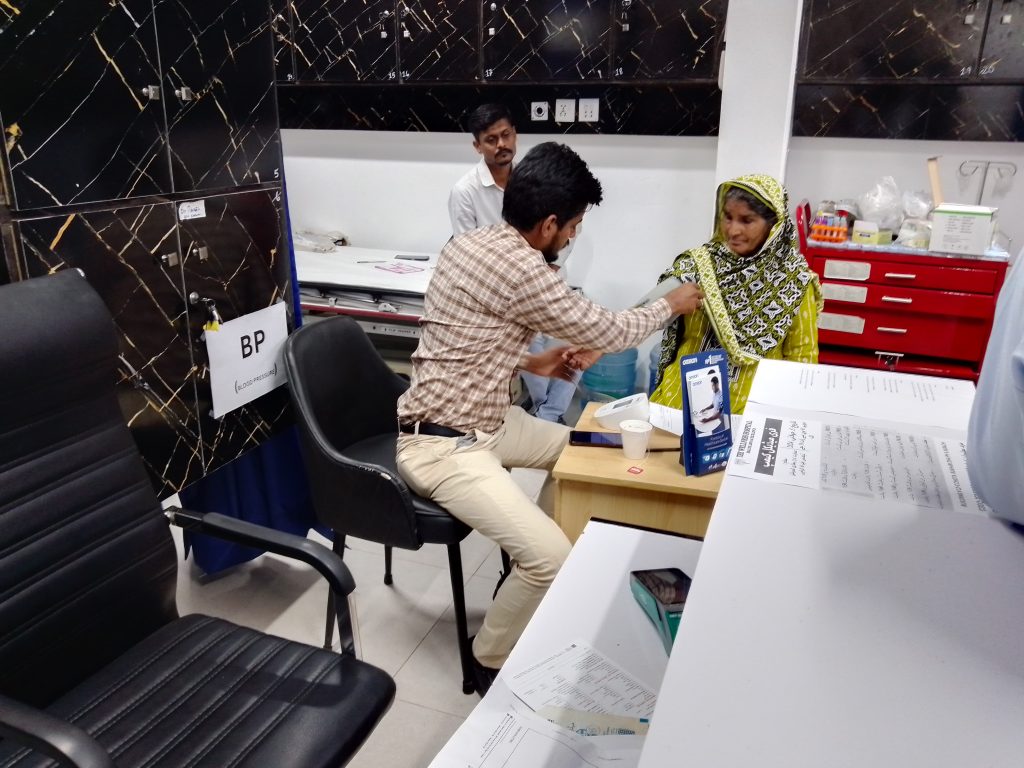

At The Wellness Hospital, Zakat is more than just charity – it’s a lifeline for those in need. Your Zakat enables us to deliver life-saving medical care and vital healthcare services to the vulnerable in Pakistan.

We understand the importance of Zakat as a spiritual obligation and a means of helping those in need. With our 100% Zakat Policy, every penny of your Zakat donation goes directly to providing essential medical care to the poor, sick, and vulnerable.

“Our established aid chain ground-relief efforts, and years of experience will ensure your support goes towards.”

WHAT IS ZAKAT?

An obligatory annual payment, Zakat is paid by qualifying adult Muslims whose wealth exceeds the Nisab value for one Islamic (lunar) year. This donation pleases Allah (SWT). Payments are made to support those most in need both domestically and around the world.

The Holy Qur’an determined who is eligible to receive Zakat, stating:

“As-Sadaqat (Zakat) are only for the Fuqara’ (poor), and Al-Masakin (the needy) and those employed to collect (Zakat funds); and for to attract the hearts of those who have been inclined (towards Islam); and to free the captives; and for those in debt; and for Allah’s Cause (i.e. for Mujahidun – those fighting in the holy wars), and for the wayfarer (a traveler who is cut off from everything); a duty imposed by Allah. And Allah is All-Knowing, All-Wise.”

Chapter at-Tawbah Tevbe, 60

Why Give Your Zakat to The Wellness Hospital?

Zakat is an opportunity to purify your wealth and make a tangible difference in the lives of those who rely on our support. Your Zakat will:

- Provide Critical Medical Care

Help cover the costs of life-saving treatments, surgeries, and healthcare services for those who cannot afford them.

- Support Orphaned And Vulnerable Children

Ensure that children from disadvantaged backgrounds receive specialised healthcare and medical attention.

- Empower Women’s Health Services

Fund maternal health programs that offer safe deliveries, pre and postnatal care, and reproductive health services.

- Improve Community Health

Through mobile clinics, health camps, and preventive care programs, your Zakat helps us reach underserved communities with vital healthcare services.

Our 100% Zakat Policy

At The Wellness Hospital, we are committed to ensuring that 100% of your Zakat is used in strict accordance with Islamic principles and goes directly to those who qualify to receive it. Our 100% Zakat policy ensures:

- No Administration Fees

Every Zakat donation is fully allocated to patient care and community health programs.

- Direct Aid To The Needy

We ensure that your Zakat benefits individuals who are eligible under Shariah law, such as the poor, sick, or unable to pay for medical services.

WHO IS ELIGIBLE FOR ZAKAT?

This means that Zakat donations cannot be given to just anyone. A husband cannot give his Zakat to his wife as he is already responsible for her, just as he is his children. A wife, though, is permitted to give Zakat to her husband, so long as he meets the relevant criteria – she must not benefit in any way from this donation (i.e. the husband using the funds to pay for a gift for his wife).

Those eligible to receive Zakat can be placed into one of eight categories, which are:

- The poor.

- The needy

- Administrators of Zakat, Muslim Aid USA for example.

- Reconciliation of Hearts.

- Those in Bondage/Captive.

- Those in Debt

- In the Cause of Allah.

- The Travelers.

Not every Muslim is obligated to pay Zakat as per the rules set out in the holy Qur’an. To be eligible to pay Zakat, you must be past the age of puberty, of Muslim faith, sound mind, free, and have a positive cash/goods flow, as well as a personal wealth that exceeds the Nisab value.

Muslim Aid USA will ensure Zakat payments are restricted to responding to emergencies to save lives in Muslim majority communities and supporting specific development projects that are taking place in Muslim majority communities. Meaning your zakat will help provide emergency food, shelter for refugees, job training, medication, and so much more

WHAT IS NISAB?

Nisab is the threshold for which a Muslim’s personal wealth must be above if he or she is to be eligible to pay Zakat. There are two Nisab values from which the threshold is determined, which are:

- Gold – the monetary value of 87.48 grams of gold .

- Silver – the monetary value of 612.36 grams of silver.

Because the valuation of gold and silver fluctuates so, too, does the Nisab threshold. This is why tools such as our Zakat calculator prove so helpful as they help Muslims to quantify not only whether they qualify to pay Zakat, but how much it is they owe. A Muslim’s wealth must exceed the Nisab threshold for one full Islamic year, or ‘Hawl’, which is the term for a lunar year, which lasts for 354 days.

If your personal wealth dropped below the Nisab threshold at any point during the Islamic year but was above it both and the beginning and end of the Hawl, you should speak to your local imam for advice.

WHEN SHOULD I PAY ZAKAT?

You should pay your Zakat when your wealth has exceeded the Nisab threshold for one full Islamic year from the point your wealth first exceeded the threshold. The amount of Zakat you owe should be calculated on the day you make your payment. This means that regardless of by how much your wealth was above the Nisab threshold during the year, it is how your wealth stands at that moment from which your Zakat is calculated.

The holy month of Ramadan is the most popular time of year for Muslims to pay their Zakat as it is believed that donating during this time yields multiplied rewards and blessings. You can, though, pay Zakat any time during the year if your wealth has exceeded the Nisab threshold for a lunar year. This should also not be confused with Zakat al Fitr, or Fitrana, which must be paid during the month of Ramadan before the Eid prayers.

HOW MUCH ZAKAT DO I NEED TO PAY?

The Zakat that you owe is calculated on:

- 2.5% of personal wealth and annual savings.

- 5% of a farmer’s assets where the farmer has funded the irrigation of crops.

- 10% of a farmer’s assets where the farmer’s crops have been irrigated by rain.

- 20% of valuables and resources on the property, such as gold, silver, and oil.

WHAT SHOULD I INCLUDE IN MY ZAKAT CALCULATION?

Your owed Zakat is calculated on your wealth, including personal assets and cash. Zakat is only payable on a property that does not contribute to your day-to-day living – i.e. a second home which you do not live in should be included in your calculations while your first home, the one in which you do live, should not be included. This is also true for vehicles, with your second car eligible to be included in your Zakat calculations as it is considered to be a luxury, while your first care is considered a necessity and is not to be included.

The assets that are eligible to be considered for Zakat are:

- Cash at home, in a bank, or savings accounts.

- Funds saved for a special occasion or reason.(such as hajj, a deposit on a property or a wedding, etc…)

The value of any gold and silver in your possession. - Any stocks and shares that you own.

- The total value of any income generated from renting out an owned property

(such as a second home). - The value of any debt you have acquired that you expect to be returned(such as lending money to a friend/relative)

What not to consider when calculating Zakat:

- Any payments due to be paid in the month you pay your Zakat.

- Money that you owe such as mortgage/rent payments, card debts, and personal loans.

- Items such as household appliances and clothing.

- Business expenditures including bills, salaries, rents, and rates.

- Business loans and overdrafts.

WHAT IS ZAKAT-UL-FITR (FITRANA)?

Zakat al Fitr, or Fitrana, is a different payment to Zakat that can only be made during the holy month of Ramadan, before the start of Eid. Fitrana is traditionally given as food, but Muslim Aid USA will accept monetary donations, valued at $10 per person in the United States, which will pay for food to be given to those most in need.

FAQs About Zakat At The Wellness Hospital

Zakat is one of the Five Pillars of Islam, a fundamental act of worship that purifies our wealth and souls. It reminds us that our wealth is not just for ourselves but for the benefit of all humanity.

Our 100% Zakat Policy guarantees that every penny of your Zakat donation is used to directly benefit eligible recipients without any deductions for administrative or other costs.

Zakat is given to those in financial need, such as the poor, orphans, the sick, and individuals or families who cannot afford medical care.

Zakat is generally calculated as 2.5% of savings and wealth held for a lunar year.